Calculate compound interest with different compounding frequencies and monthly deposits.

Disclaimer: This calculator and its results are for informational purposes only and do not constitute financial advice. While we strive for accuracy, please consult with a licensed financial advisor or professional before making any financial decisions. We are not responsible for any actions taken based on the information provided by this tool.

Understanding APY and Compound Interest

Key Terms

- APR (Annual Percentage Rate): The nominal interest rate per year without considering compounding

- APY (Annual Percentage Yield): The effective annual rate, accounting for compound interest

- Compound Interest: Interest earned on both the principal and accumulated interest

Compound Interest Formula

For a principal amount with regular deposits, the formula is:

\[ A = P \left(1 + \frac{r}{n}\right)^{nt} + PMT \cdot \frac{\left(1 + \frac{r}{n}\right)^{nt} – 1}{\frac{r}{n}} \]

Where:

- \(A\) = Final amount

- \(P\) = Principal (initial deposit)

- \(r\) = Annual interest rate (APR)

- \(n\) = Number of times interest is compounded per year

- \(t\) = Time in years

- \(PMT\) = Regular payment amount

Understanding the Relationship Between APY and APR

APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are closely related but serve different purposes in financial calculations:

- APR: The nominal annual interest rate, which does not account for compounding.

- APY: The effective annual rate that includes the impact of compounding, providing a more accurate representation of the true return or cost over a year.

Mathematical Relationship

The relationship between APY and APR depends on the compounding frequency (n) per year. The formula is:

\[ APY = \left(1 + \frac{APR}{n}\right)^n – 1 \]

Where:

- \(APY\): Annual Percentage Yield (effective annual rate)

- \(APR\): Annual Percentage Rate (nominal rate)

- \(n\): Number of compounding periods per year

Key Insight

As the compounding frequency increases, the APY becomes higher than the APR because interest is added to the principal more frequently, allowing subsequent interest to be calculated on a larger base.

An Analogy: The Snowball Effect

Imagine rolling a snowball down a hill:

- APR: This is like describing how much snow the ball will pick up after a single roll — a fixed rate.

- APY: This measures how much snow the ball gathers after rolling multiple times and increasing in size with each roll, showing the true growth over time due to compounding.

Example Comparison

Suppose you have an APR of 5% with different compounding frequencies:

- Annually (\(n = 1\)): \(APY = (1 + \frac{0.05}{1})^1 – 1 = 5.00\%\)

- Monthly (\(n = 12\)): \(APY = (1 + \frac{0.05}{12})^{12} – 1 = 5.12\%\)

- Daily (\(n = 365\)): \(APY = (1 + \frac{0.05}{365})^{365} – 1 = 5.13\%\)

This demonstrates how higher compounding frequencies amplify the effective yield, making APY more representative of actual growth or cost.

Programmatic Implementation of APY/APR

Python Implementation:

Here’s how to implement compound interest and APY calculation in Python:

def calculate_compound_interest(P, r, n, t, PMT=0):

A = P * (1 + r / n) ** (n * t) + PMT * (((1 + r / n) ** (n * t) - 1) / (r / n))

return A

def calculate_apy(apr, n):

return (1 + apr / n) ** n - 1

# Example Usage

principal = 1000

annual_rate = 0.05

compounds_per_year = 12

time_years = 5

monthly_deposit = 100

final_amount = calculate_compound_interest(principal, annual_rate, compounds_per_year, time_years, monthly_deposit)

apy = calculate_apy(annual_rate, compounds_per_year)

print(f"Final Amount: ${final_amount:.2f}")

print(f"APY: {apy * 100:.2f}%")APY: 5.12%

R Implementation:

The same calculations can be implemented in R:

calculate_compound_interest <- function(P, r, n, t, PMT=0) {

A <- P * (1 + r / n)^(n * t) + PMT * (((1 + r / n)^(n * t) - 1) / (r / n))

return(A)

}

calculate_apy <- function(apr, n) {

return((1 + apr / n)^n - 1)

}

# Example Usage

principal <- 1000

annual_rate <- 0.05

compounds_per_year <- 12

time_years <- 5

monthly_deposit <- 100

final_amount <- calculate_compound_interest(principal, annual_rate, compounds_per_year, time_years, monthly_deposit)

apy <- calculate_apy(annual_rate, compounds_per_year)

cat(sprintf("Final Amount: $%.2f\n", final_amount))

cat(sprintf("APY: %.2f%%\n", apy * 100))APY: 5.12%

Example: Comparing Different Compounding Frequencies

Let’s assume an Annual Percentage Rate (APR) of 5% and compare the resulting APY for different compounding frequencies:

def calculate_apy(apr, n):

return (1 + apr / n) ** n - 1

# Example APR and compounding frequencies

apr = 0.05

frequencies = {"Annual": 1, "Monthly": 12, "Daily": 365}

# Calculate APY for each frequency

for freq_name, n in frequencies.items():

apy = calculate_apy(apr, n)

print(f"{freq_name} Compounding: APY = {apy * 100:.2f}%")Output:

Monthly Compounding: APY = 5.12%

Daily Compounding: APY = 5.13%

Explanation: As the compounding frequency increases, the APY grows slightly because interest is applied more often within the year. The difference becomes more noticeable at higher interest rates or over longer time periods.

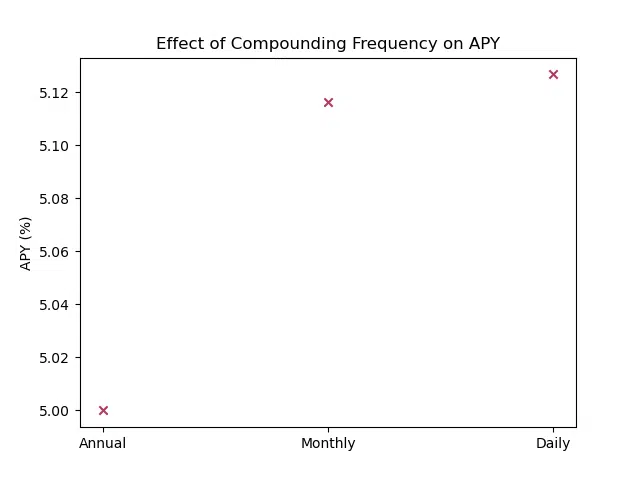

Visualizing the Effect of Compounding

You can visualize how compounding affects APY over time using a graph. Here’s an example using Python with Matplotlib:

import matplotlib.pyplot as plt

# APR and compounding frequencies

apr = 0.05

frequencies = [1, 12, 365]

labels = ["Annual", "Monthly", "Daily"]

# Calculate APY for each frequency

apy_values = [(1 + apr / n) ** n - 1 for n in frequencies]

# Plot the results

plt.scatter(labels, [apy * 100 for apy in apy_values], color="#b03b5a", marker='x')

plt.ylabel("APY (%)")

plt.title("Effect of Compounding Frequency on APY")

plt.show()

Insights: The visualization highlights how compounding frequency enhances APY. For most practical purposes, monthly or daily compounding provides a noticeable advantage over annual compounding.

FAQs on Statistical Considerations

Q: How do small APR changes affect APY?

Even small changes in APR can lead to noticeable differences in APY due to compounding. This effect becomes more pronounced with higher compounding frequencies.

Q: Does the currency affect the APY or compound interest calculations?

No, the currency does not impact the calculations as APY and compound interest are percentage-based metrics that work with relative values. The results will always be in the same currency as the initial deposit and monthly deposits entered by the user.

However, currency might matter in the following cases:

- If you need to convert the results into another currency, the final amounts will depend on the exchange rate used.

- Clearly displaying the currency symbol in inputs and outputs ensures users correctly interpret the results.

Q: What are APY and APR used for?

APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are used to measure returns and costs in various financial contexts:

- Investments: APY is used to calculate the true annual return on savings accounts, bonds, or certificates of deposit (CDs), considering compound interest.

- Loans: APR represents the yearly interest rate on loans, mortgages, or credit cards, showing the cost of borrowing.

- Comparing Financial Products: APY and APR help consumers compare products like savings accounts, loans, or investment options based on their effective annual rate or cost.

- Budgeting: Knowing the APY and APR helps individuals plan financial goals, evaluate potential earnings, or understand borrowing costs.

In summary, APY shows how much you'll earn, while APR shows how much you'll owe over a year, making them essential for making informed financial decisions.

Q: How do market factors affect APY?

Market factors like inflation and interest rate changes can alter the real value of APY. Adjusting for inflation gives the real APY, which is more representative of purchasing power.

Attribution Statements

If you found this calculator useful, please consider linking back to us using one of the following attribution statements:

-

HTML Attribution:

<p>Source: <a href="https://researchdatapod.com/apy-calculator/" target="_blank" rel="noopener">The Research Scientist Pod - APY Calculator </a></p> -

Markdown Attribution:

[Source: The Research Scientist Pod](https://researchdatapod.com/apy-calculator/) -

Plain Text Attribution:

Source: The Research Scientist Pod - https://researchdatapod.com/apy-calculator/

Feel free to use these formats to reference our tools in your articles, blogs, or websites.

For further reading please go through the links in the following section.

Further Reading

Have fun and happy researching!