R provides several powerful tools for financial market analysis. This tutorial will go through how to download and plot the daily stock prices from Yahoo! Finance using quantmod. Yahoo finance provides free access to historic stock prices at the time of writing this article.

Table of contents

Install quantmod package

There are several ways to download financial data using R. In this tutorial we will use the quantmod package, which is the most commonly used package. We can install quantmod as follows from the R console:

install.packages("quantmod")

The prices we download using quantmod are stored as xts and zoo objects.

Install broom

We also need to install broom to allow us to manipulate the stock prices in preparation for ggplot2.

install.packages("broom")

How to Find Stock Prices

You can find stock prices by going to investment websites like NYSE or Google Finance and entering the company name in the website’s search engine. The search will return the ticker symbol along with other financial information about the company.

Get Stock Prices from Yahoo Finance

First, we will need to load the relevant packages for the analysis.

library(quantmod) library(ggplot2) library(magrittr) library(broom)

Next, we will download the Nvidia stock prices using quantmod from 23rd February 2020 to 23 February 2021.

options("getSymbols.warning4.0"=FALSE)

options("getSymbols.yahoo.warning"=FALSE)

We need to pass the ticker symbol for Nvidia, which is NVDA, as well as the source, which is Yahoo and the time ranges.

We can define the start and end date using as.Date and pass the variables to the from and to arguments.

The quantmod package downloads and stores symbols with their names, which we can turn off by passing the argument auto.assign = FALSE to the getSymbols function.

start = as.Date("2020-02-23")

end = as.Date("2021-02-23")

getSymbols("NVDA", from = start, to = end, src="yahoo", warnings=FALSE, auto.assign=TRUE)

[1] "NVDA"

We can look at the first rows using the head function as follows:

head(NVDA)

NVDA.Open NVDA.High NVDA.Low NVDA.Close NVDA.Volume NVDA.Adjusted 2020-02-24 67.5475 70.4675 67.0000 68.3200 85691600 68.13633 2020-02-25 69.0750 69.6975 64.4900 65.5125 105549600 65.33637 2020-02-26 65.5150 68.8625 65.5000 66.9125 74773200 66.73260 2020-02-27 63.7250 66.7500 62.2225 63.1500 90641600 63.01790 2020-02-28 60.6150 68.1150 60.4475 67.5175 113325200 67.37625 2020-03-02 69.2250 69.3975 65.2500 69.1075 89074400 68.96292

We can verify the class of the NVDA object using the class function as possible:

class(NVDA)

[1] "xts" "zoo"

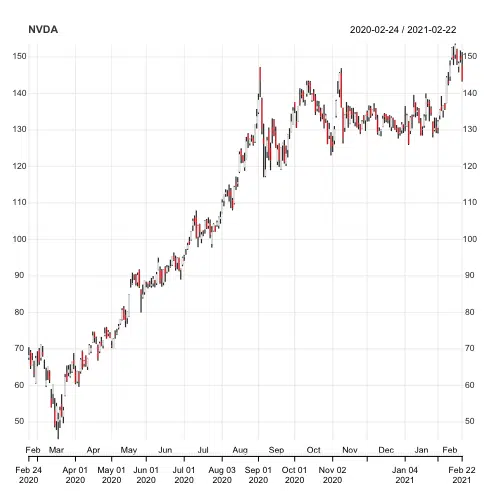

Chart Series of Stock Price in R

Now that we have the data, we can plot the NVDA object using the chart_Series function. The function returns a candlestick chart, which we can use to determine possible price movement based on past patterns.

chart_Series(NVDA)

We can zoom into a particular period of the series by putting the dates in square brackets. For example, let’s zoom in between February and June 2020 and:

chart_Series(NVDA['2020-02/2021-06'])

Plot Multiple Stocks using quantmod

We can use the getSymbols function to retrieve multiple stock prices. We need to store the tickers symbols in a character vector. We will choose three other technology stocks. The tickers we need are “AAPL” (Apple), “NVDA” (Nvidia), “MSFT” (Microsoft), and “GOOGL” (Google).

We will keep the date ranges and the source the same.

start = as.Date("2020-02-23")

end = as.Date("2021-02-23")

getSymbols(c("AAPL", "NVDA", "MSFT", "GOOGL"), src="yahoo", from = start, to = end, warnings=FALSE, auto.assign=TRUE)

Organize Stocks as Data Frame

We can store the stock prices as a data frame using as.xts and set the column names and indexes of the data frame using names() and index().

stocks = as.xts(data.frame(A = AAPL[, "AAPL.Adjusted"], B = NVDA[, "NVDA.Adjusted"], C=MSFT[, "MSFT.Adjusted"], D=GOOGL[, "GOOGL.Adjusted"]))

names(stocks) = c("Apple", "Nvidia", "Microsoft", "Google")

index(stocks) = as.Date(index(stocks))

head(stocks)

Let’s get the first rows of the data frame using the head() function.

head(stocks)

Apple Nvidia Microsoft Google 2020-02-24 73.42667 68.13631 167.4141 1419.86 2020-02-25 70.93955 65.33636 164.6514 1386.32 2020-02-26 72.06491 66.73261 166.7088 1390.47 2020-02-27 67.35416 63.01790 154.9626 1314.95 2020-02-28 67.31476 67.37625 158.7148 1339.25 2020-03-02 73.58181 68.96292 169.2755 1386.32

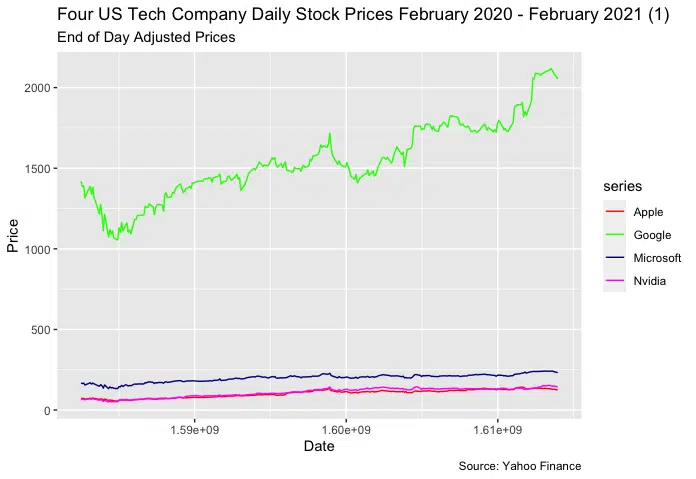

Let’s attempt to plot the four stock price movements on a single chart using ggplot2.

stocks_plot = tidy(stocks) %>%

ggplot(aes(x=index,y=value, color=series)) +

labs(title = "Four US Tech Company Daily Stock Prices February 2020 - February 2021 (1)",

subtitle = "End of Day Adjusted Prices",

caption = " Source: Yahoo Finance") +

xlab("Date") + ylab("Price") +

scale_color_manual(values = c("Red", "Green", "DarkBlue","Magenta"))+

geom_line()

stocks_plot

We can see the the stock price for Google dwarfs the other three stocks, making them difficult to interpret. We can solve this by plotting the stocks on individual sub-charts using a facet grid.

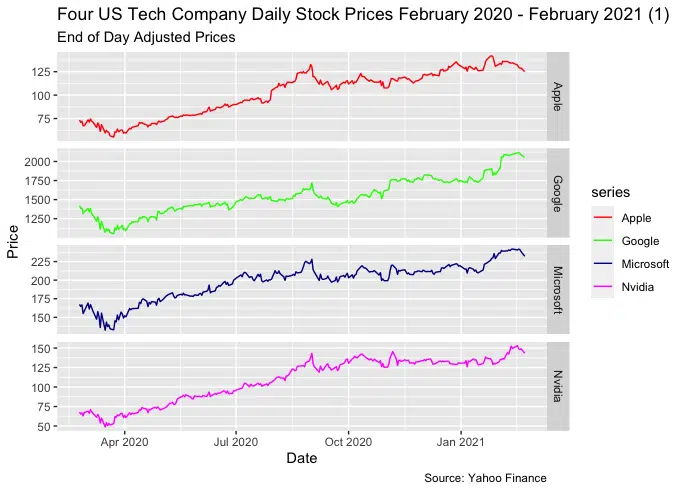

Plot Multiple Stocks as a Facet Grid using quantmod

We can plot the four stock prices using facet_grid(), which forms a matrix of panels defined by row and column faceting variables.

stocks_plot2 = tidy(stocks) %>%

ggplot(aes(x=index,y=value, color=series)) +

geom_line() +

facet_grid(series~.,scales="free") +

labs(title = "Four US Tech Company Daily Stock Prices February 2020 - February 2021 (1)",

subtitle = "End of Day Adjusted Prices",

caption = " Source: Yahoo Finance") +

xlab("Date") + ylab("Price") +

scale_color_manual(values = c("Red", "Green", "DarkBlue","Magenta"))+

geom_line()

stocks_plot2

Let’s run the code to see the result.

We successfully showed the stock prices for the four companies on separate panels.

Summary

Congratulations on reading to the end of the tutorial!

For finance-related tools, go to our free Black-Scholes Options Pricing Calculator.

Go to the online courses page on R to learn more about coding in R for data science and machine learning.

Have fun and happy researching!

Suf is a senior advisor in data science with deep expertise in Natural Language Processing, Complex Networks, and Anomaly Detection. Formerly a postdoctoral research fellow, he applied advanced physics techniques to tackle real-world, data-heavy industry challenges. Before that, he was a particle physicist at the ATLAS Experiment of the Large Hadron Collider. Now, he’s focused on bringing more fun and curiosity to the world of science and research online.